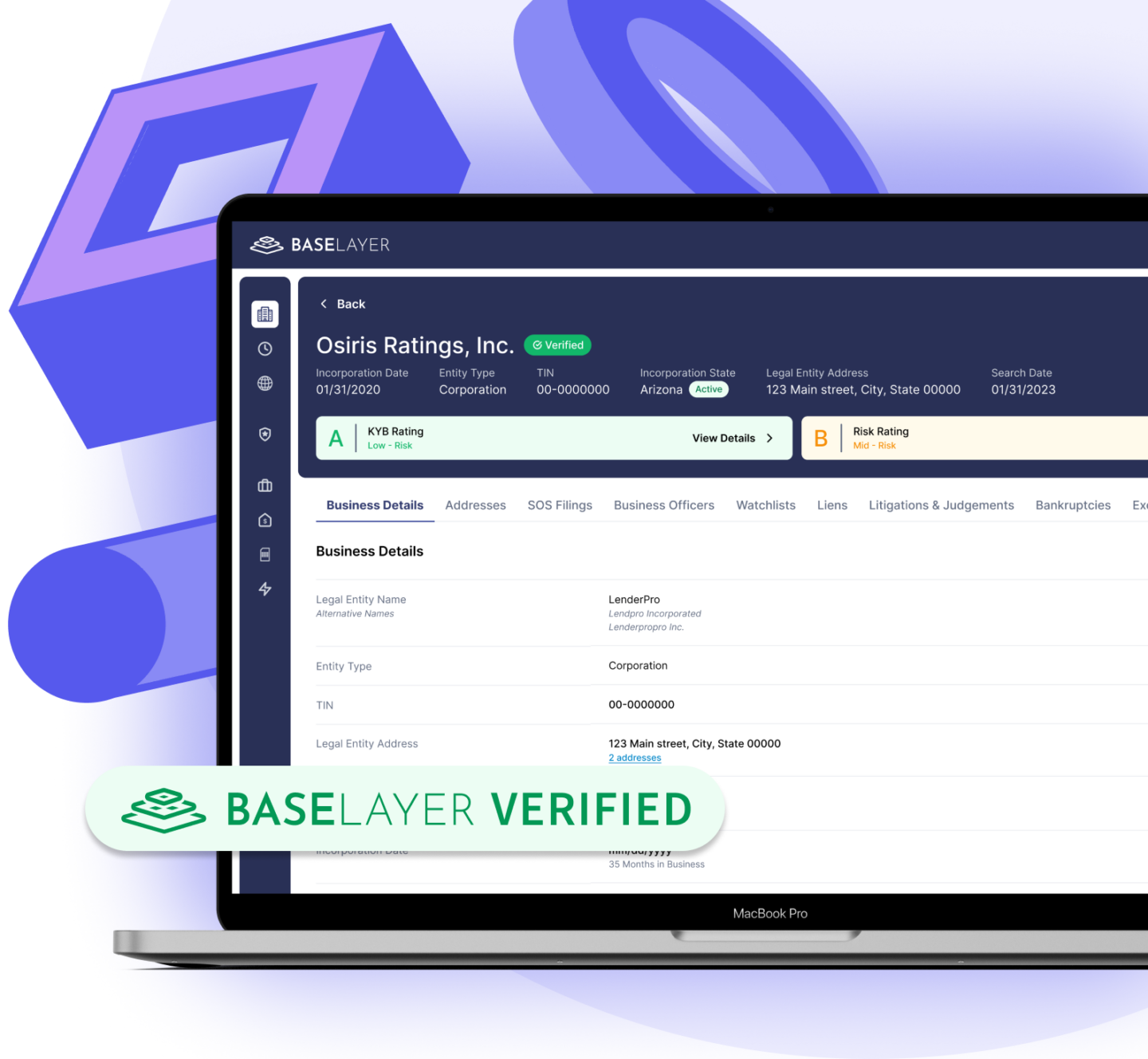

Delivering the most comprehensive identity insights, Baselayer’s platform equips businesses with fully automated solutions for KYB, Risk, and Fraud management, setting new standards in business verification.

Get a Demo

KYB, fraud, and risk checks consumes significant time and resources. Manual reviews are not only slow, but also increase the potential for errors, delaying the entire verification process.

Overlooked fraud indicators and unchecked risks compromise secure lending, increasing the likelihood of financial losses.

Collecting data from various sources is tedious and it’s easy to miss details. When key info is missing, verification becomes less reliable, leading to delays and potential compliance issues.

Streamline KYB, risk assessment, and fraud evaluation with a single platform that brings unmatched efficiency and clarity to your business operations.

Enhance your business verifications with state secretary validation, IRS/EIN matching, sanctions screening (OFAC, PEP), and business officer and registered agent detection.

Sharpen your risk assessment by evaluating a borrower’s industry, legal history, and web presence alongside revenue and transaction projections. Detect banned borrowers from other financial institutions, uncover credit stackers months in advance, and expose synthetic identity creators with our advanced fraud solutions.

Harness Baselayer’s all-in-one Platform to pinpoint which businesses need your attention — and get your manual reviews down to as close to zero as possible.

Stay proactive by monitoring updates from the Secretary of State and banking or credit applications. Optimize your portfolio using real-time indicators for fraud, churn risk, and credit stacking.

Supercharge your growth with our proprietary data and advanced machine learning models. The Baselayer Product Suite is continuously trained with millions of business applications keeping you ahead of evolving fraudsters.

Dive into our comprehensive suite or customize your toolkit with individual solutions that amplify your existing Fraud, KYB, Risk and Portfolio Monitoring systems.

Leverage Baselayer’s team of ML experts to seamlessly turbocharge your operations with every new business onboarded; you’re the expert, we’re the engine.

Baselayer’s SOC 2 Certified Systems ensure rigorous adherence to industry best practices, safeguarding your data through every layer of our infrastructure. With us, compliance is not just a checklist; it’s woven into the fabric of our operations.

Jumpstart your journey with the Baselayer Dashboard in mere seconds, or integrate our developer centric API into your own environment. Whichever you choose, our dedicated implementation team is ready to assist, ensuring a smooth integration.